Vague Specifics June 2022

It would appear the eruption has ended, at least for now.

There is still an ungodly amount of money pouring in from California, the land where people sold their shanties for $2 million and threw it around like Monopoly Money on the DFW market. But with skyrocketing interest rates comes diminished home affordability. And it needs to calm down, at least for a time, before Dallas turns into California.

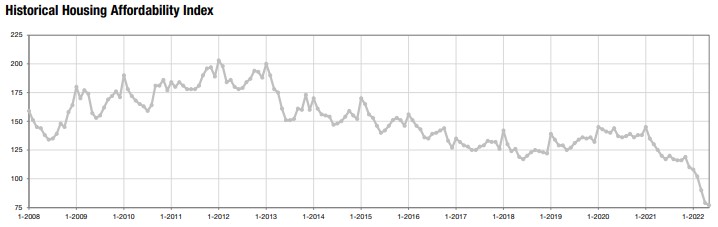

Above graph for the DFW metroplex and affordability. It measures the median home price in a given area relative to what the typical family can afford with a 30-year fixed-rate mortgage. An index of 100 means the average family can afford the median sales price. We were once at twice that number, now we’re at .75. Dallas was historically one of the more undervalued markets in the United States. Unfortunately those days are over. All the way through 2013 DFW was a very cheap place to live. Now the number hovers around .75.

Interest rates are going to continue to affect affordability, at least for we mere mortals who have not just sold our shanties for $2 million. As of 6/23, a 30-year fixed-rate mortgage is hovering around 6.125%. Still below the historic average of around 8%, but expect them to be up around 7% by the end of summer. In short, the days of cheap money are over.

This has to be the hottest June I can remember. We all must consider the last several years, while humid, have been compartatively mild. We’ve had 6 days over 100 as of 6/22. In all of 2021 we had 8 days, 2020 9, 2019 14 and 2018 23. The record was 71 set in 2011. Here’s to hoping we don’t set any records moving foward, although I’ll take dry heat over humidity.

Vague Specifics May 2022

You know that time when you’re about to sneeze when your body has pulled in so much air your lungs are about to explode but before the actual sneeze? That’s what the May 2022 market felt like. Is it the pause before the market crash? Will prices suddenly come falling back to Earth? Will the house you just bought in March suddenly lost 20% of it’s value.

No.

The market has absolutely calmed down since interest rates began to rise towards more historic norms (remember, the average interest rate for a 30-year fixed is 8%), and it’s causing buyers sticker shock. Will this last? No. I’m giving it 6 weeks before people remember they need a home.

The geniuses who predicted “transitory” inflation are now giving us a 50/50 chance of hitting a recession before 2024. A recession is technically defined as 2 consecutive quarters of negative Gross Domestic Product (GDP) growth. The US GDP contracted by 1.4% in the first quarter of 2022, I’d speculate we’re in the middle of a recession. How long it continues I don’t know.

“But John, you trustworthy yet mysterious renaissance man,” I hear you ask, “surely a recession will cause the market to correct.”. Well, dear reader, there are quite a few different types of buyers out there, and many of them view real estate a safer investment than the stock market right now, and they’re putting their money into it. There are also buyers about whom I’ve discussed ad nauseum, namely buyers who sold their Malibu CA shanty for $2.5 million and are giddy with the affordability of DFW real estate. Without them, higher interest rates and an economic recession would likely send DFW into at least a static market.

As I’m writing this, it’s been 24 hours since the shooting in Uvalde. If you’re able, I’m sure there will be relief charities for the families of the victims. If you hear of any, please let me know and I’ll share it on social media. I don’t often chime in social media during tragedies, I’ve learned emotional comments tend not to age well.

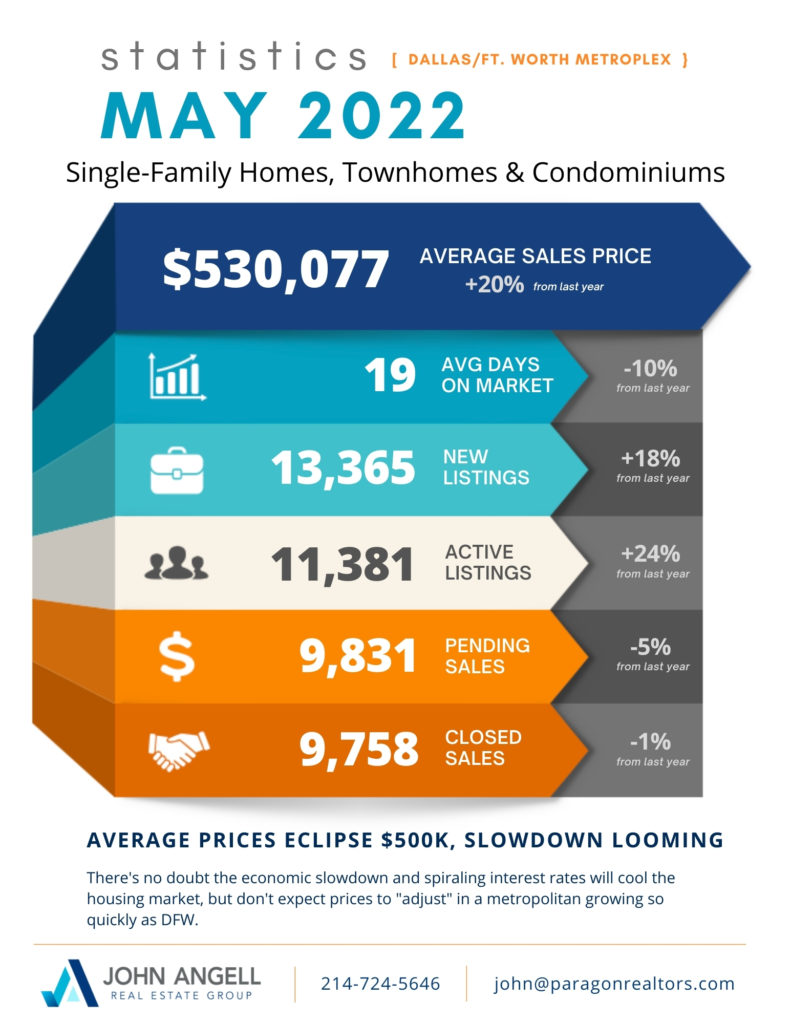

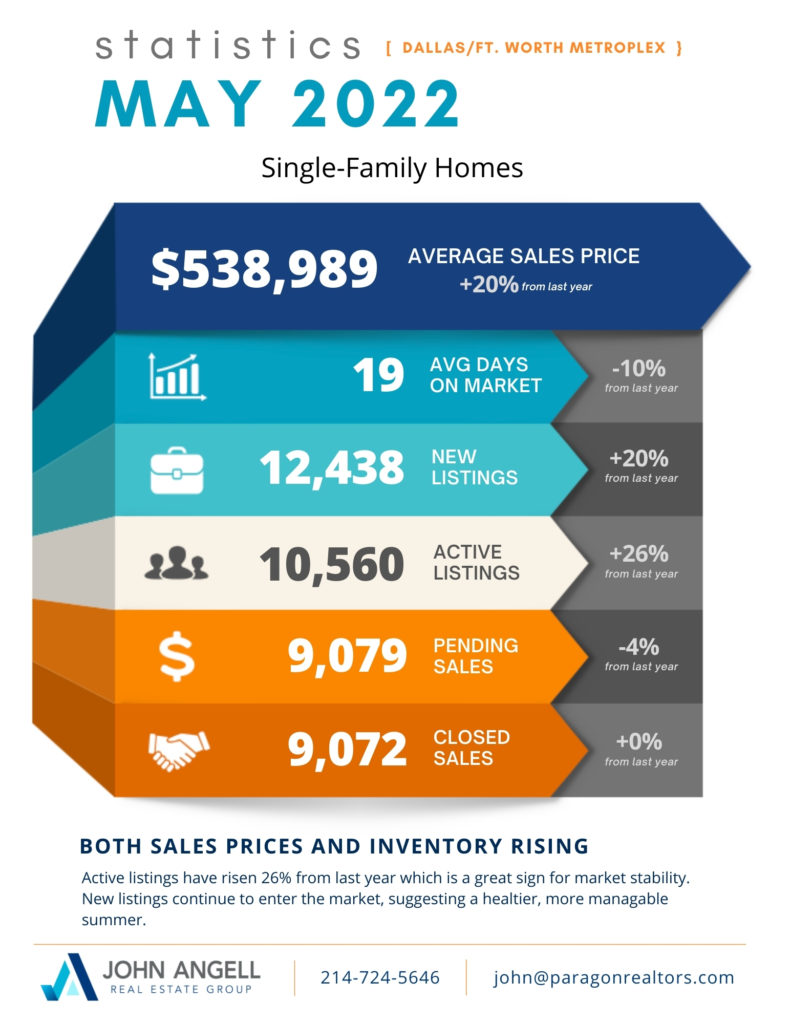

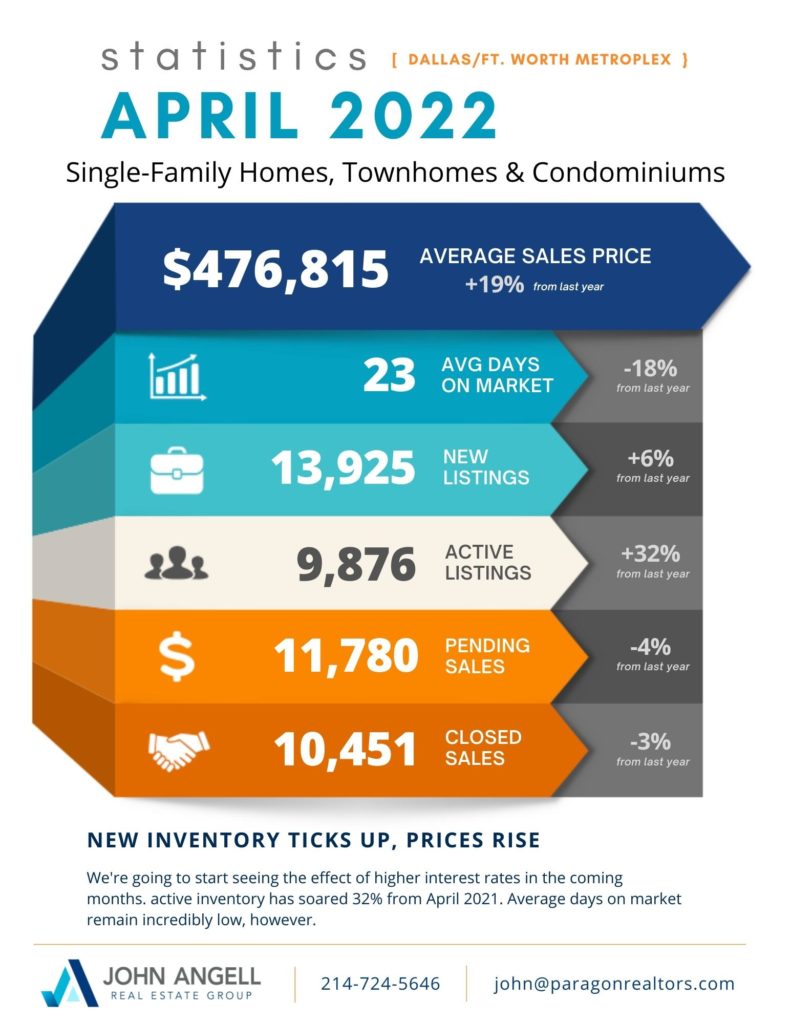

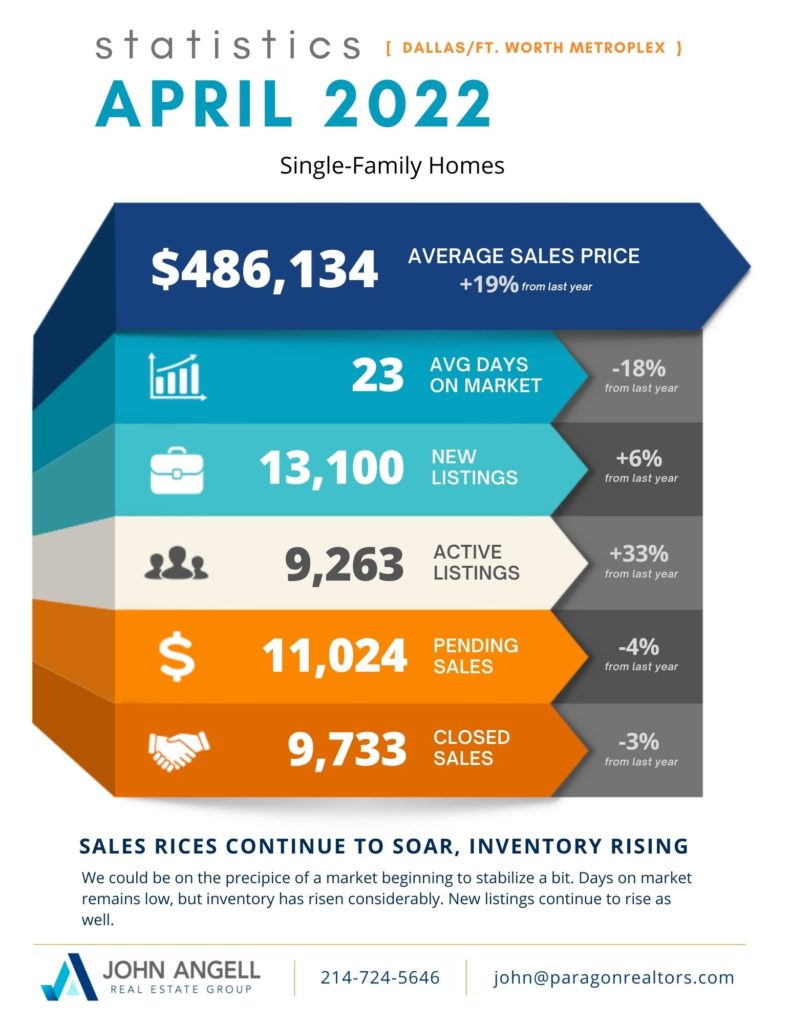

MLS Statistics May 2022

Architectural Corner: Spanish Colonial

From Florida to California and throughout the southwestern states, Spanish Colonial homes date all the way back to the 1600’s when Spanish settlers began building their homes in North America.

Characterized by red clay tile roof, thick, white stucco walls, relatively few, smaller windows, and exposed wood support beams, they were designed around hot climates and to maintain coolness inside. Courtyards are also common, long ago used for cooking. Decorations were usually somewhat minimalist. Earlier homes were not well-suited for cold, humidity, and could swell if exposed to too much water, causing the stucco to fall apart.

Spanish Colonials are very popular in newer construction homes now that the technology has allowed for better stucco and central heat, although many builders (like Clifford Hutsell in the early 1900s) abandoned stucco for brick.

Real Estate 2022: Your Agent Matters

For those of you who’ve been reading my newsletters for awhile, you know behind the tongue-in-cheek self-aggrandizement I try to provide you with genuine value, writing what I hope to be useful information and not just cut-and-paste Realtor marketing. That said, in the wild-and-crazy market of 2022, your Realtor matters, and can be the difference between buying/selling and not.

There have been sellers markets during which you could just stick a sign in your yard and wait for offers to roll in; in all markets you can approach a seller or their Realtor and submit an offer without a Realtor of your own. It’s worth repeating that I tip my hat to anyone who is able to represent themselves buying and selling, and does so to save money and not just to satisfy their ego. Unfortunately this market is different. One of the reasons you hire a Realtor is to understand norms, and by that I don’t mean which boxes to check or what to fill in on the contract. You also need to know to the velocity of the market and from the perspective of people who experience the market every day.

Regarding sellers, an enormous part of my job now is not just orchestrating marketing, compiling offers and negotiating the best terms, but to find which buyer has the best chance of showing up to closing. Sounds ridiculous, but when a seller signs a contract it’s almost like a blood-pact. It has precious few outs and no easy fixes if the buyer doesn’t perform. Buyers remorse is at an all-time high and they are more squirrelly than I’ve ever seen them. If you get left at the closing table it could cost you thousands and demolish your immediate plans.

For buyers, if you’re making a move on on a hot property with a seasoned agent who understands the market, you’re at least the running. If you don’t have an agent who knows what it takes to be competitive – like a relative who’s “trying real estate” or “sells a couple houses a year”, you’re facing an almost impossible battle. If you’re being “savvy” and representing yourself, unless you have an angle you don’t stand a chance.

Work with a full-time, full-service agent who can competently represent you.

Scammers in Real Estate – If it’s too Good to be True…

PT Barnum is credited with having said, “There’s a sucker born every minute.”; which is cynical but not inaccurate. However, scammers are getting more and more sophisticated, and it’s easy to imagine getting taken advantage of, even by professionals in the target industry. I ALMOST fell for a Facebook Marketplace scam 2 weeks ago, and felt like Colombo.

In todays’ internet-driven real estate market, roughly half of the homes I list end up being used by scammers. They take a property that’s for sale, steal the photographs, and list it for lease on real estate sites that allow for owners to directly advertise their rental homes. Their goal is to get deposit money – typically $500 – $1,000 – and the pace of today’s market is on their side because when Realtors aren’t involved, there’s a level of trust that’s almost always assumed between landlord and tenant. They do this for a living, and although they often don’t even live in the US, they can be very convincing.

Need one telltale sign that a rental house is a scam? If it’s listed at a price that’s too good to be true, it’s a scam. They almost always target the lower socioeconomic class, and it kills me when I have a half-million dollar house on the market and field calls inquiring about the house that’s “for lease” for $1,000 per month. Just last week I was walking out of a listing and was met at the front door by a single mother. She had 3 kids under 10 years old in her very modest car, and was about to wire the “owner” $800 deposit. Thank God our paths happened to cross and I was able to stop her. The encounter really got to me. These lowlifes often think all Americans are wealthy, they milk people for money that they genuinely can’t afford to lose, and probably sleep just fine at night. This lady would have been in real trouble if she lost $800, never mind she may have ended up homeless because the lease for her old property was probably up. 3 kids, a small car, out $800 and no place to live.

If you ever happen across a lease (or purchase) online that looks to be too good, please call me and I’ll do some research. I’d rather spend 30 minutes doing some vetting than hear about a friend/client/neighbor getting scammed.

Beyond Spring Cleaning: Servicing Your HVAC

Maintaining your HVAC (heating, ventilation and air conditioning) system is something that is often overlooked until it is too late. To avoid having to make what can be insanely expensive repairs or a full replacement, follow a few simple steps:

Change Your Filters – The easiest thing you can do is keep your filters clean, and it makes a profound difference in the inherent stress placed on your system. Dirty, clogged filters can lower your air conditioner’s efficiency by 5-15%, and even worse, it can shorten it’s life considerably. Most technicians suggest replacing your filter every 1-2 months, depending on the filter. One thing I’ve also learned in 12 years of real estate is that a dirty air filter is often a sign of a negligent seller, and if the filter looks like it hasn’t been changed in years, chances are other mechanicals are suffering from serious neglect.

Schedule Seasonal Servicing – General rule of thumb is to have a licensed technician inspect your system before your system before the first time you turn on your air conditioner or heater. It’s more of a safety issue with the heater – especially if it’s gas-powered – but if your air conditioner is out of coolant, it can be miserable.

Monitor Your Compressors – It’s important to keep your outside system clean, and free of debris. Leaves will eventually fall into the system, the paint will eventually start to peel, but if you have cottonwood trees nearby, ivy growing, or tall grass, your exterior coils can easily become clogged. Clogged coils will decrease your unit’s efficiency and can end up drastically shortening the lifespan of your system.

I know it’s February, and difficult to imagine the blazing summer that’s only a few months away. It was a comparatively cold winter, and looking in at my back yard, it’s hard to imagine it will soon be a lush, green field of St. Augustine.

There are 3 keys to a good lawn: proper fertilizing, mowing, and regular irrigation.

It all starts with good fertilizing. Calloway.com suggests to fertilize in early March, and do so every 8-10 weeks (bearing in mind they have fertilized they want to sell you). I’ve learned twice a year is fine – once in March, once in October. Depending on what type of grass you have, there are different fertilizers. If you’re really interested in finding the right fertilizer, visit www.soiltesting.tamu.edu.

Mowing is not only critical in keeping your neighbors off your back and the city from writing you tickets, it causes grass to spread laterally. More coverage means fewer weeds. Mowing on a regular basis – weekly or every other week – is very important as well.

Irrigation (also called watering) is of obvious importance. One inch per week during the spring, 2 inches per week during the summer, one inch in the fall, and 1/2 inch in the winter. Just because it’s cold outside doesn’t mean your yard doesn’t need water.

Weeds are another matter. There are two types of weed killers: pre-emergent and post-emergent. Spring is time for treating pre-emergent weeds, and make sure the fertilizer you use treats for regional weeds. They will appear throughout the summer, there’s no way around that, but using a pre-emergent weed killer is more than an ounce of prevention in the war on weeds.

https://johnangellrealestate.paragonrealtors.com/2022/02/24/331289/

Vague Specifics – February 2022

For the first time in a couple of years, the economic forecast is showing genuinely troubling signs. We have long been due for a Wall Street adjustment; the inevitable adjustment has been propped up for quite a few years by deficit spending and cheap money. With inflation rising, the Fed has had to raise rates pretty dramatically, leading to a full-point spike in interest rates for a 30-year fixed mortgage. In context, that puts rates right around 4%, which is still obscenely low. I remember when I was a kid, auto dealerships offered 19.9% financing. A $400k house on a 30-year note at 4% is roughly $1,800/mo (minus taxes and insurance). On 20% it’s more like $5,600. Yeesh.

“But John, you omniscient seer,” I hear you ask, “is the DFW market faced with a correction?”. Well, dear reader, no, Unless the laws of supply-and-demand economics are turned upside down. Tens of thousands of refugees from California continue to wash up on our fertile shores, with nary the clothes on their backs and $4,000,000 in their bank accounts after selling their shanties in Malibu. We’re also seeing an incredibly high number of first-generation Americans enter the metroplex. I had 30 offers on a listing just outside Allen, 27 of them were from either Indian, Asian or Persian-Americans. I heard a great many stories about parents wanting to buy a piece of property for their children, I wish I could have sold all of them acreage.

As of my writing this, I’m staring out the window at a frozen wasteland. Temperatures stand at 25 degrees, traffic is at a minimum. God, I miss the days of minimal traffic. If there’s one thing that really frustrates me about Dallas’ growth, it’s the traffic. It’s high-time we hit the age of flying cars.