If you look the most recent MLS statistics, the signs are all over the place. Median days on market is still very low comparative to historic averages, but market inventory has doubled and interest rates have certainly stretched home affordability. While I’ve been told we’ll see rates in the upper 5’s this spring and summer, recent economic reports have shown that current rates are not cooling down inflation. It would appear that the “soft landing” we were hoping for will turn into a recession. To those of us who remember the Great Recession, it’s unlikely we’ll see anything like that. Real estate was a if not the primary driver then, now the market slowdown is just a byproduct of more money that has ever been printed in human history being pumped into the US economy.

If there is a positive statistic to the market leveling off, it’s home affordability. Dallas was historically one of the most affordable major metropolitan areas in the United States (probably due in part to our crippling summers and lack of natural topography…). Since the 80’s, however, DFW has worked very hard to present a very diverse economy, and the benefits are being reaped in the form of mass migration to the area. Unfortunately, basic rules of supply and demand have driven up home prices because as the old real estate idiom says, “They ain’t making any more dirt.”.

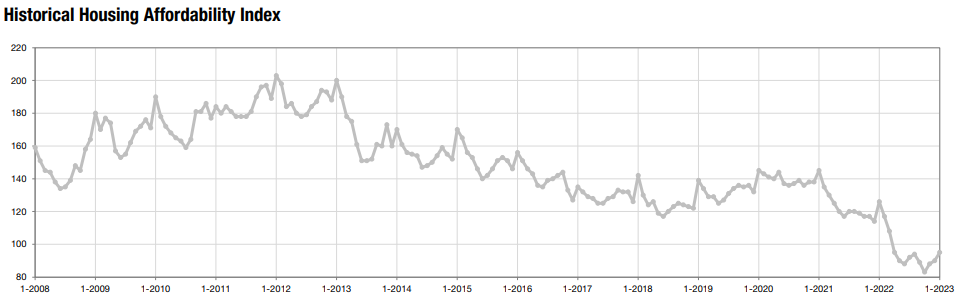

A housing index of 100 means the median income home can afford the median-priced home. We’re hovering slightly below that right now, and it’s not being helped by the slow return to normal homebuilding rates. It’s likely going to drop a bit over the next few months as it does the first half of every year, but I wouldn’t be surprised if it eclipses 100 in the winter, which is when many are predicting the recession is going to arrive. Hopefully I’m wrong.

Leave a Reply